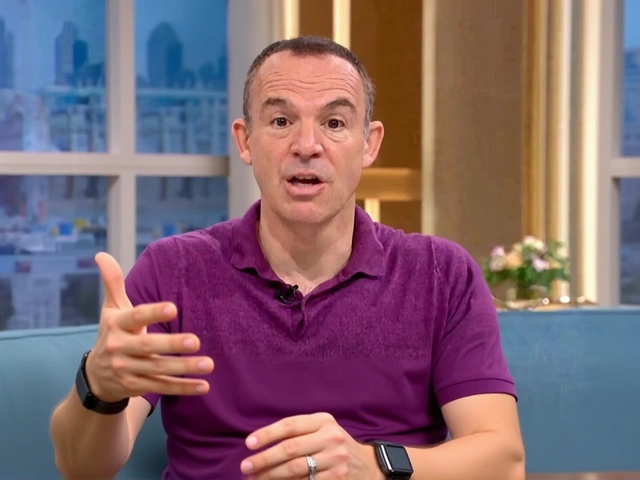

Martin Lewis Announces FCA's £8.2bn Car Finance Redress for 14 Million Brits

When Martin Lewis, founder of Money Saving Expert posted an update on October 8, 2025, the headline was hard to miss: the Financial Conduct Authority (FCA) will force lenders to cough up £8.2 billion for roughly 14 million motorists who were mis‑sold car‑finance deals between April 6 2007 and November 1 2024. The average payout? About £700 per consumer – a figure that feels modest compared with the earlier £9‑£18 billion ranges floated by Money Saving Expert just a few months earlier.

Why the scheme matters

The FCA’s redress plan, officially titled the car finance compensation schemeUnited Kingdom, is more than a financial settlement; it’s a public‑policy wake‑up call. Nearly every auto loan signed in the last 17 years – an estimated 99 % – included a commission model, and 40 % of those featured a “discretionary commission arrangement” that dealers never disclosed to borrowers.

Here’s the thing: when a dealer earns extra money because you pay a higher interest rate, the regulator treats that as a hidden cost passed straight to you. The FCA says three patterns drive the mis‑selling: discretionary commissions, contracts that tie dealers to finance providers, and outright excessive commissions. If you weren’t told about any of this – which, frankly, most weren’t – you’re likely eligible for compensation.

The three buckets of mis‑selling

Lewis broke the ugly details down on his YouTube channel on October 7, 2025. In an 8‑minute‑42‑second video he said, “The FCA has announced that as many as 14 million finance agreements may have been mis‑sold, with lenders ordered to pay out £8.2 billion.” He then listed the three categories:

- Discretionary commission arrangements – dealers get a bigger cut if you’re stuck with a higher APR, and they never tell you the rate is inflated.

- Contractually tied dealers – the dealer has a binding agreement with the lender, nudging you toward that lender’s product regardless of suitability.

- Unfairly high commissions – the dealer simply pockets an outsized fee, again without clear disclosure.

Lewis warned, “If you were told all the ins and outs of what you were being sold – which is unlikely – then you won’t be eligible for the compensation.”

How to claim – a step‑by‑step guide

For most people, the process begins with a formal complaint to the lender before the FCA’s redress scheme kicks off in 2026. Lewis supplied a downloadable template (mse.me/ytCarFinanceTemplate) and stressed the importance of joining the “already complained” pool. Why? The regulator will treat anyone who has lodged a complaint before the scheme starts as pre‑qualified, speeding up their payout.

Don’t have the original paperwork? Lewis says a credit reference file, an old bank statement showing the monthly finance charge, or even a registration document that lists the finance company can be enough. He added, “If you can prove you had a car finance deal at that time, that could be sufficient.”

And a word of caution: if you previously hired a claims‑management firm, expect them to take up to 50 % of any award. Going direct is free and, according to the FCA, “no win, no fee” for the consumer.

Who’s on the hook?

The scheme drags a handful of big‑name lenders into the spotlight. Among the affected firms are Santander Consumer UK, Black Horse Ltd (a trading style of Lloyds Banking Group), and Close Brothers Motor Finance. All were authorised to provide motor finance during the relevant window and now must factor the £8.2 billion hit into their balance sheets.

Industry insiders say the numbers will shave a noticeable chunk off profit forecasts for 2026, especially for banks that relied heavily on motor‑loan margins. Yet some commentators, like Sarah Jones, senior analyst at Bright Analytics, argue it could push lenders to adopt more transparent pricing – a win for consumers in the long run.

Broader impact on the UK auto‑finance market

What does this mean for the average driver? Besides the immediate cash infusion, the FCA’s move is likely to tighten oversight of commission structures. Dealers may have to display “commission‑free” labels, and lenders could be forced to disclose the exact APR breakdown on contracts.

Interestingly, the Financial Ombudsman Service – which handled individual complaints before the FCA intervened – will now serve as a back‑stop for any disputes that slip through the redress pipeline. The service, based in London, expects a surge in queries once the scheme launches.

From a macro perspective, the £8.2 billion figure represents roughly 0.6 % of the UK’s annual GDP, a sizable but not destabilising outlay. It also signals that regulators are willing to go after entrenched practices that have lingered for nearly two decades.

What’s next?

The FCA says the first batch of claims will be processed in early 2026, with a full roll‑out by the end of that year. Consumers should keep an eye on official communications from their lenders and the FCA’s website, which will host a portal for uploading supporting documents.

Martin Lewis will continue to update his audience via Money Saving Expert’s blog and YouTube channel. His next video, scheduled for early November, promises a “live Q&A” to field the most common questions as the scheme goes live.

Frequently Asked Questions

How does the compensation scheme affect people who have already settled their car finance deals?

Even if your loan ended years ago, you may still qualify for a payout. The FCA says agreements that finished within the last six years are covered, provided you can prove the finance existed. Old bank statements or credit‑reference reports can serve as evidence.

What if I used a third‑party claims firm before hearing about the FCA scheme?

Claims firms typically keep up to 50 % of any award. Once the FCA’s redress starts, you can still submit a direct claim, but you’ll need to coordinate with the firm to avoid double‑payment. Many consumers are opting to withdraw from third‑party arrangements and claim for free.

Which types of vehicles are covered by the scheme?

The redress applies to cars, vans, camper‑vans and motorbikes that were purchased on finance. It does not extend to commercial fleet contracts that fall outside standard consumer finance rules.

When will I receive my compensation?

The FCA aims to start processing claims in early 2026, with most payouts expected within six months of a successful claim. Exact timelines will depend on the volume of applications and the speed of evidence verification.

What role does the Financial Ombudsman Service play after the scheme launches?

The Ombudsman will act as an arbitrator for disputes that arise if consumers feel the FCA’s payout calculation is incorrect. It provides an independent avenue for appeals without additional cost to the claimant.